39+ does my mortgage pay my property taxes

Most state and local tax. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

What Is Mortgage Interest Deduction Zillow

The property tax percentage.

. Web Property taxes are an ad valorem tax so the tax is based on the value of the property. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. 1 If you have a mortgage your property tax may be rolled into your.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web If you want to estimate your property taxes you can use the formula below. Check Out Our Rates Comparison Chart Before You Decide.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Also at closing was the 2409 a payment to the tax authority or a funding of your escrow account. Web The property tax rate that you pay at the local county and state level is often referred to as the millage rate or mill rate.

Unfortunately there are no. Web New Jersey at an average local tax rate of 249 has the highest property tax rate in the US. Web The amount you owe in property taxes is fairly easy to calculate.

Others pay through a portion of their monthly mortgage payment. The assessed value of the home. To find out if these will have.

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web Under federal tax law the mortgage interest and local property taxes you pay may decrease the portion of your income that is subject to tax. Web What if my property real estate taxes are paid through my mortgage lender.

Your monthly payment includes your mortgage payment consisting of principal and interest as well as. Web There are many reasons why your monthly payment can change. Web First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider allowing you to pay your property.

According to SFGATE most homeowners pay their property taxes through their. These rates are usually based on how. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. If the seller has already paid for the entire year when.

So if you have a mortgage. Ad Looking For a Mortgage Refinance. Call the tax office - first make sure there is not a mistake at the tax office.

Youll just need some information. Web Here are the steps you can take. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web Some property taxes are paid every six months or yearly. 5 Lowest Mortgage Refinance Rates Are Now Available In The US. Call them and advise them your tax payments are being.

Web If your real estate property tax bill is 3000 per year the lender will set the monthly amount you pay into the escrow account at 250. Companies are required by law to send W-2. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

State has no property tax. Web If your mortgage servicer did not pay your taxes you should send a copy of the bill along with a notice of error which is a letter disputing the error to your. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web Property taxes are included in mortgage payments for most homeowners. Assessed home value x tax rate property tax The tax rate can also be expressed as.

It should be included in escrow if thats how you set up your mortgage. Web For example where I am property taxes are paid twice a year. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year.

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

What Am I Paying For With My Monthly Mortgage Payment

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

My Mortgage Escrow Doesn T Pay Property Tax On Time R Mildlyinfuriating

Tbd Eldred Yulan Road Eldred Ny 12732 Mls H6190727 Trulia

Does My Mortgage Pay My Property Taxes

How To Tell If Your Taxes Are Included In Your Mortgage Pdx Home Loan

View Real Estate At State Highway 58 Georgetown Tn 37336 Unreal Estate

73698 E County Road 22 Byers Co 80103 Zillow

For Sale W Middletown Road North Lima Oh 44452 Unreal Estate

910 Knight Drive Durham Nc 27712 Mls 2478343 Howard Hanna

3bhk For Sale In The Tallest Tower In The Area 39 6 Levels Of Parking

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Realizing Property Tax Savings With An Escrow Account Five Stone Tax Advisers

Mortgage Payments Explained Principal Escrow Taxes More

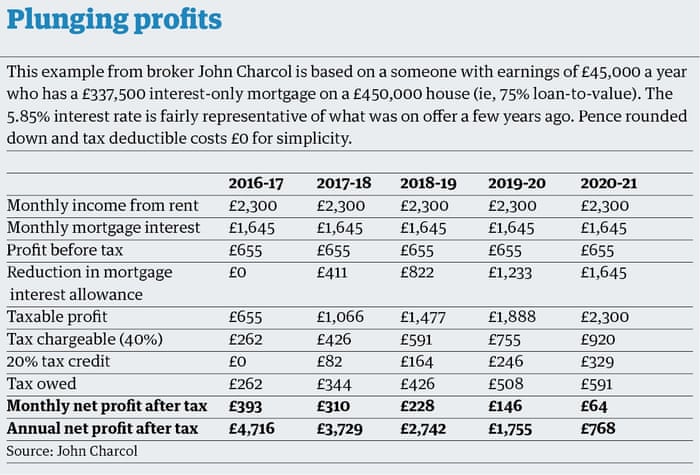

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

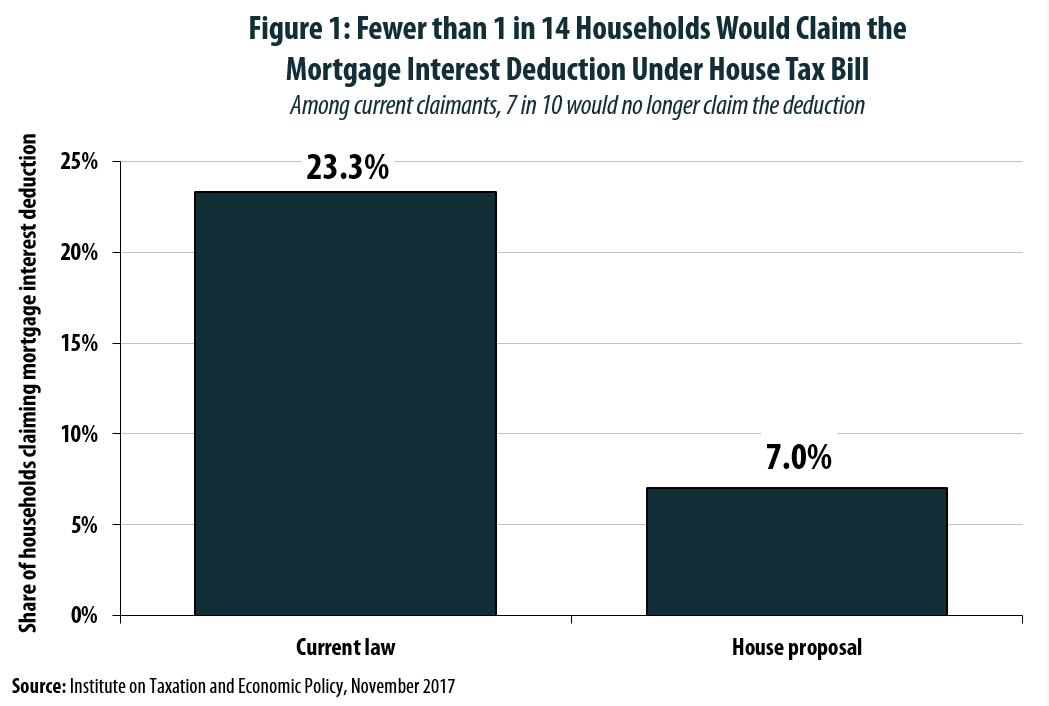

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep